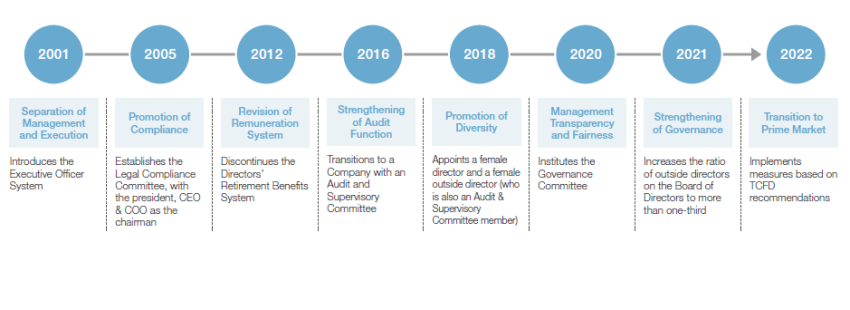

Enhancing the Effectiveness of Corporate Governance

The Evolution of Chori’s Corporate Governance

Evaluation of the Effectiveness of the Board of Directors

Chori conducts an evaluation of the effectiveness of the Board of Directors each year in order to realize a more effective Board of Directors. The evaluation process involves conducting a questionnaire with all directors on the composition, operation, discussions, and support system of the Board of Directors and then compiling the views of each director.

Based on the results of the questionnaire, the Governance Committee and the Board of Directors evaluate and analyze the effectiveness of the Board of Directors as a whole. The results confirmed that the Board of Directors, including outside directors, is appropriately composed, engages in constructive discussions and exchange of opinions through open and active dialogue, and is generally operating appropriately while maintaining its overall effectiveness.

The results also confirmed improvements in addressing an issue identified in the previous fiscal year—ensuring sufficient oversight and monitoring of the establishment and operation of internal control systems, including at subsidiaries. Regarding ongoing issues, the Company recognizes the need to increase the frequency of discussions and conduct more in-depth reviews when monitoring progress on the medium-term management plan. Opinions were shared on the importance of thoroughly discussing profitability and capital efficiency when formulating management strategies and plans, as well as reviewing how succession planning and director compensation are discussed and reported at Board of Directors’ meetings based on deliberations by the Governance Committee.

Hereafter, we will continue to discuss management and business issues we have identified and continuously work to improve the effectiveness of the Board.